Theme Pack Presentation Overview:

Want to learn more about this Theme Pack? Click the video to the left to get an overview! Combined presentation time: 15h

How to Earn Your CE Credits?

This is a simple 3 step process 1. Watch all 15 presentation videos 2. Complete all parts of the curriculum (listed below) 3. Click the Complete Course button at the end. Good news for you, is that there are no quizzes!

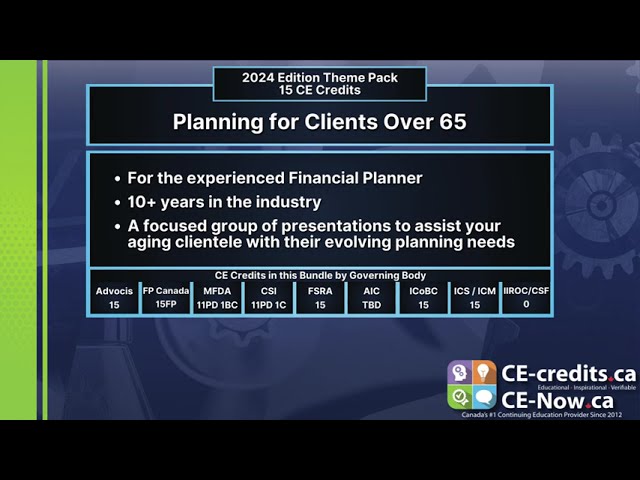

CE Credits provided by this presentation:

* FP Canada - 15 Financial Planning credits * Advocis - 15 IAFE Approved credits * MFDA - 11 Professional Development & 1 Business Conduct credits * CSI - 11 Professional Development & 1 Compliance credits * FSRA - 15 FSRA Approved credits * ICS - 15 Life Insurance credits * ICM - 15 Life Insurance credits & acceptable to many other organizations.

Curriculum

-

1

2024 Planning for Clients Over 65 Theme Pack - 15 Credits

-

(Included in full purchase)

Planning for Clients Over 65 Theme Pack Overview

-

(Included in full purchase)

The Rules Governing CE Credits

-

(Included in full purchase)

Welcome to Part 1

-

(Included in full purchase)

-

2

1 - Building Strong Client Connections with Your Brand - April Levitt & Kelly Maxwell, The Personal Coach

-

(Included in full purchase)

Presentation Overview

-

(Included in full purchase)

Presentation Video

-

(Included in full purchase)

Presenter Resourses

-

(Included in full purchase)

-

3

2 - The Psychology Of Retirement - Mike Drak, Booming Encore

-

(Included in full purchase)

Presentation Overview

-

(Included in full purchase)

Presentation Video

-

(Included in full purchase)

Presenter Resourses

-

(Included in full purchase)

-

4

3 - Your Whole Life Advantage - Zainab Sheikh, CPP Foresters

-

(Included in full purchase)

Presentation Overview

-

(Included in full purchase)

Presentation Video

-

(Included in full purchase)

Presenter Resourses

-

(Included in full purchase)

-

5

4 - The Holy Grail of Personal Health Insurance Information - Evan Morgan, CompareHealth.ca

-

(Included in full purchase)

Presentation Overview

-

(Included in full purchase)

Presentation Video

-

(Included in full purchase)

Presenter Resourses

-

(Included in full purchase)

Break Time

-

(Included in full purchase)

-

6

5 - Capital Gains Changes: Impacts and Tax Planning Opportunities for Canadian Individuals - Jay Goodis, Tax Templates

-

(Included in full purchase)

Presentation Overview

-

(Included in full purchase)

Presentation Video

-

(Included in full purchase)

Presenter Resourses

-

(Included in full purchase)

-

7

6 - Financial Planning: Optimize Advise & Succeed - Raphi Zaionz, MyGoals

-

(Included in full purchase)

Presentation Overview

-

(Included in full purchase)

Presentation Video

-

(Included in full purchase)

Presenter Resourses

-

(Included in full purchase)

-

8

7 - The Shocking Uses of Reverse Mortgages - Andrew Cairns, HomeEquity Bank

-

(Included in full purchase)

Presentation Overview

-

(Included in full purchase)

Presentation Video

-

(Included in full purchase)

Presenter Resourses

-

(Included in full purchase)

-

9

8 - Add $10M Under Management with Existing Clients - Barry Gordon, Gordon Downsizing & Estate Services

-

(Included in full purchase)

Presentation Overview

-

(Included in full purchase)

Presentation Video

-

(Included in full purchase)

Presenter Resourses

-

(Included in full purchase)

Break Time

-

(Included in full purchase)

-

10

Welcome to Part 2

-

(Included in full purchase)

Break Time

-

(Included in full purchase)

-

11

9 - Supporting Your Clients Through Aging Life Transitions - Marc Seguin, Advocacy in Aging

-

(Included in full purchase)

Presentation Overview

-

(Included in full purchase)

Presentation Video

-

(Included in full purchase)

Presenter Resourses

-

(Included in full purchase)

-

12

10 - The Estate Enhancement Option - Zainab Sheikh, CPP Foresters

-

(Included in full purchase)

Presentation Overview

-

(Included in full purchase)

Presentation Video

-

(Included in full purchase)

Presenter Resourses

-

(Included in full purchase)

-

13

11 - How Selling Underground Furniture Morphed into the Mortality Mindset Movement - Greg Barnsdale, Do Not Ignore Your Mortality

-

(Included in full purchase)

Presentation Overview

-

(Included in full purchase)

Presentation Video

-

(Included in full purchase)

Presenter Resourses

-

(Included in full purchase)

Break Time

-

(Included in full purchase)

-

14

12 - Incorporating Canada Life Annuities - Michael Edmison, Canada Life

-

(Included in full purchase)

Presentation Overview

-

(Included in full purchase)

Presentation Video

-

(Included in full purchase)

Presenter Resourses

-

(Included in full purchase)

-

15

13 - Executor Myth Busters Workshop - Jim Kibble, Ontario Estate Consulting Solutions

-

(Included in full purchase)

Presentation Overview

-

(Included in full purchase)

Presentation Video

-

(Included in full purchase)

Presenter Resourses

-

(Included in full purchase)

-

16

14 - The $1 Trillion Wealth Transfer That Wasn't - Chris Paterson, Beneva

-

(Included in full purchase)

Presentation Overview

-

(Included in full purchase)

Presentation Video

-

(Included in full purchase)

Presenter Resourses

-

(Included in full purchase)

-

17

15 - Is Strategic Philanthropy Part of Your Clients' Estate Planning - Mark Halpern, WEALTHinsurance.com

-

(Included in full purchase)

Presentation Overview

-

(Included in full purchase)

Presentation Video

-

(Included in full purchase)

Presenter Resourses

-

(Included in full purchase)

-

18

Congratulations

-

(Included in full purchase)

Congratulations

-

(Included in full purchase)

About your MC: Alan Hoffman

Alan began his career in 1996 as a Financial Advisor with London Life. Since 2012, Alan Hoffman and CE-credits.ca has been working to create Continuing Education that actually provides Canada’s Financial Advising community with content that is truly relevant and useful within their practices. Through CE-Now.ca, they provide advisors with easy on demand access to earn their CE Credits the way they prefer, through webcasts, bundles, theme packs, and a library of over 450 presentations to learn from. Today, CE-credits.ca is the #1 CE Provider in Canada.

2024 Planning for Clients Over 65 Theme Pack - 15 Credits

Stay ahead of the evolving needs of serving aging clients! Join the Planning for Clients Over 65 theme pack to gain essential insights and strategies. Earn CE Credits easily—just watch, no quizzes! Click “Start Theme Pack Now” to get started!

$225.00